Individual Returns

(Individual / Sched C – Sole Proprietor / Single Person LLC)

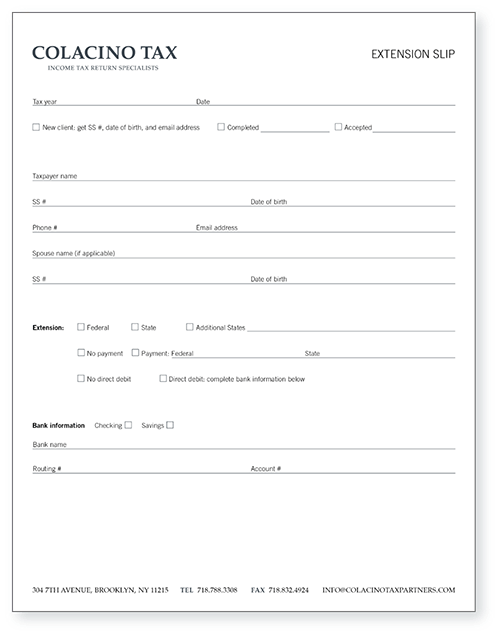

Existing Clients can file an extension through our office for a $50.00 fee. Please print out the Extension Slip (PDF) and submit it with a request for extension to info@colacinotax.com.

Federal Extension:

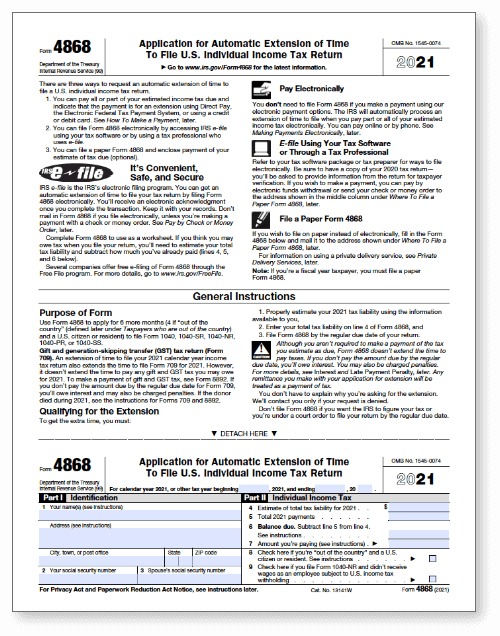

You may also download Form 4868 and file an extension yourself.

Filing an extension (Form 4868) applies only to the tax filing deadline*—April 15th, 2024, which allows for a six-month extension. It does not allow for extension of any payment due on your federal tax returns, which you must estimate and submit with your form. If you don’t file an extension with payment by the deadline, you will pay a Failure to File penalty. Please see below for the appropriate State extension.

*The tax deadline is only for individuals who owe taxes to the IRS.

State Extensions:

(Penalties and interest also apply to state extensions)

Business Returns

(S-Corps / Partnerships / Multi-member LLCs)

Existing Clients can file an extension through our office for $100.00. After March 10, 2024, our fee will increase to $175. Please print out the Extension Slip (PDF) and submit it with a business return extension request to info@colacinotax.com.

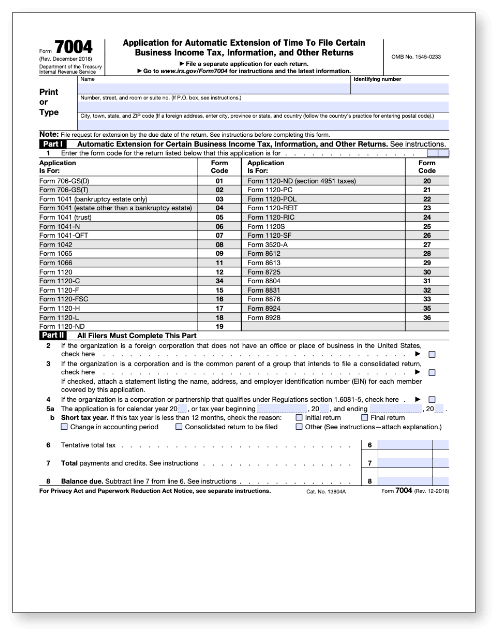

Form 7004 must be filed before the tax deadline—March 15th, 2024, which allows for a six-month extension—September 16, 2024.

Form 7004 only allows an extension of time to file. It does not allow for an extension of taxes owed to the IRS. Any late payments will incur separate penalties and interest. Please visit the IRS website for further information.